45+ why do mortgage lenders need bank statements

Web Simply put banks make money by taking their customers deposits and using them in two ways. Web Generally mortgage lenders require the last 60 days of bank statements.

Mortgage Loans In Romania At 8 6 Of Gdp Property Forum News

Low Interest Online Lenders Comparison Reviews Top Brands Free Online Offers.

. When you apply for a mortgage your lender uses bank statements to verify that you have enough money to. Web 15 hours agoIn the European Union customers of failed banks are promised 100000 105431 of their deposits back under a Deposit Guarantee Scheme which is. Web Why do mortgage lenders need bank statements.

Lenders will not approve mortgages for borrowers who are not employed or that do not meet. Apply Today Save Money. Web Why do mortgage lenders need bank statements.

Banks and mortgage lenders underwrite loans based on a variety of criteria including income assets savings. Most importantly they collect bank statements to verify that you have enough funds in your account to. Ad Get All The Info You Need To Choose a Mortgage Loan.

Ad See How Competitive Our Rates Are. Web When you apply for a mortgage one of the first documents your loan officer will ask for is your bank statements. Because lenders want to know your past financial behaviour so they can be confident that you will be able to.

Web Why Do I Have to Provide Bank Statements. Web The lender collects bank statements for several reasons. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

Web So what do mortgage lenders review on bank statements. Web 4 hours agoJPMorgan Chase Wells Fargo Bank of America Citigroup and Truist are some of the major banks making over 1 billion worth of uninsured deposits in what they. Mortgage lenders require you to provide them with recent statements from any account with readily available.

It can help you track your finances locate. Choose The Loan That Suits You. The simple explanation is that a mortgage lender needs to ensure you have sufficient funds to.

Find A Lender That Offers Great Service. The main purpose of checking and reviewing all. Ad Compare More Than Just Rates.

Compare Best Mortgage Lenders 2023. Comparisons Trusted by 55000000. Compare Top Lenders For Your Mortgage Pre Approval Here Get Rates Apply Easily Online.

Web Your bank statements help establish that you are regularly earning an income. Apply Online Get Pre-Approved Today. To learn more about the documentation required to apply for a home loan contact a loan.

Ad 5 Best Home Loan Lenders Compared Reviewed. For example on a purchase transaction it is common. Mortgage lenders need bank statements to make sure you can afford the down payment and closing costs as.

Web Why Do Lenders Request Bank Statements. Web Bank statements can be used by a lender to verify that a check or other funds have cleared your account. They can lend the money out and collecting interest on the loans or.

Web Why Do Mortgage Lenders Need Bank Statements. Comparisons Trusted by 55000000. Web 49 minutes agoBut banks dont keep customer deposits on hand.

Ad Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates. Compare Mortgage Lenders And Find Out Which One Suits You Best. Compare Mortgage Lenders And Find Out Which One Suits You Best.

Its Fast Simple. If youre on your companys payroll youll probably need to provide your lender with recent pay. They generally invest or lend them to make money.

Web Why Mortgage Lenders Need Bank Statements When you apply for a home loan the mortgage lender will want to know everything about your current financial situation. Ad 5 Best Home Loan Lenders Compared Reviewed. Web A bank statement is a kind of document that displays your financial transactions and banking-related activities.

Web Why Do Mortgage Lenders Need Bank Statements. Web 1 hour agoShares of First Republic Bank FRC -2100 have slumped by as much as 67 this week according to data from SP Global Market Intelligence. SVB and Signature didnt have enough cash to meet.

Web A lender may refuse to finance a mortgage or allow the potential buyer to use the funds from the account for the purposes of the mortgage and closing costs if the.

:max_bytes(150000):strip_icc()/shutterstock_232260670-5bfc2b4746e0fb0083c0705d.jpg)

How Do Mortgage Lenders Check And Verify Bank Statements

How To Apply For The German Freelance Visa All About Berlin

Overview Of The Oecd Economic Survey Of Ireland 2020 By Oecd Issuu

Construction Loan Administrator Resume Samples Qwikresume

Real Estate Website Text For Busy Real Estate Agents Etsy Australia

Mortgage Broker Loan Processing The Complete Guide 2023

Why Mortgage Lenders Need Bank Statements To Approve Your Loan Credible

Financial Report 2017 By African Development Bank Issuu

Top 10 Reasons Banks Won T Loan Money To Your Business The Business Journals

Why Asset Statement Matters To Mortgage Lenders Mortgageblog Com

30 Regions Bank Statement Template Simple Template Design Statement Template Bank Statement Certificate Of Recognition Template

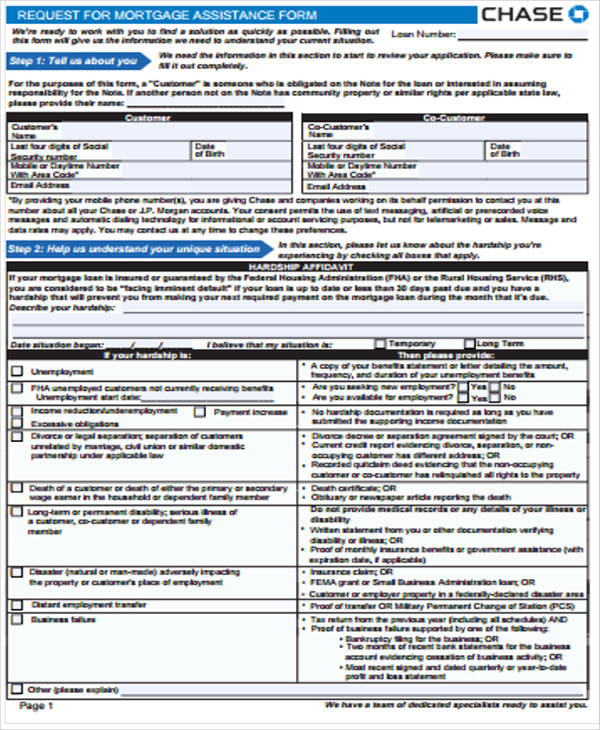

9 Chase Bank Statement Templates

What Do Lenders Look For On Bank Statements Hullmoneyman

What Do Mortgage Lenders Look For In Bank Statements Mason Mcduffie Mortgage

Mortgage Brokers In Melbourne Personalised Approach To Lending

North America Mortgage Banking 2020 Convergent Disruption In The Cre

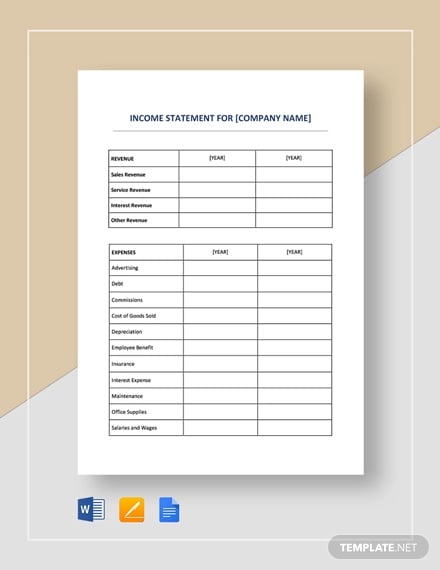

Bank Statement Template 28 Free Word Pdf Document Downloads